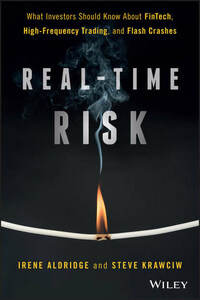

Copyright © 2017 by Irene Aldridge and Steve Krawciw. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

All cartoons © Irene Aldridge.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data is available:

ISBN 9781119318965 (Hardcover)

ISBN 9781119319061 (ePDF)

ISBN 9781119319047 (ePub)

Cover Design: Wiley

Cover Image: © PM Images/Getty Images

CHAPTER 1

Silicon Valley Is Coming!

Knock‐knock.

– Who is there?

– Bot.

– Bot who?

– Bot and sold, it's a stat‐arb world.

Do you wonder why the markets have changed so much? Where's it all heading? How will it affect you? You are not alone. Today's markets are very different from what they used to be. Technological advances morphed computers and infrastructure. Changes in regulation allowed dozens of exchanges to coexist side by side. The global nature of business has ushered in round‐the‐clock deal making. All of this has created stratospheric volumes of data. The risks that come along with automated trading in real‐time are numerous. Now, the inferences from these data allow us to go to previously untapped depths of markets and discover problems and solutions that could not even be imagined 20 years ago.

Do you remember Bloomberg terminals? If so, you are reading this book not so long after it was written. JP Morgan's January 2016 announcement “to pull the plug” on thousands and thousands of Bloomberg terminals is a leading example of the sweeping disruption facing investment managers. Billion‐dollar hedge fund Citadel followed suit on August 16, 2016, by announcing that it was taking on Symphony messaging as Bloomberg's replacement. Symphony, who? Many still struggle to wrap their head around the situation, with social media platforms like LinkedIn buzzing with discussions about pulling the plug on traditional sources of market data. Yet, here is fact: The competition is not sleeping, but working hard. And now, the competition is so strong that Bloomberg, Thomson Reuters, and others may end up in significant financial peril if they ignore fintech. Is your company also oblivious to changes in innovation?

The unfortunate truth is that many established firms are completely unprepared for the fast train of innovation currently passing them by. Old, manual procedures may have been fine in the past, but with innovation sweeping through, risk management executives have to be ready to see established operating models and platforms go out the door as newer, untried approaches take their place.